Website designed with the B12 website builder. Create your own website today.

Start for free

What do the terms"risk-on" and "risk-off" mean when referring to sentiment in financial markets?

In the world of financial markets, investors often talk about "risk-on" and "risk-off" environments. These terms provide a snapshot of overall investor sentiment and risk appetite at any given time. A "risk-on" environment signals a prevailing mood of optimism among investors, leading to a greater willingness to allocate capital towards assets considered to be higher risk, with the expectation of potentially higher returns. This positive outlook often stems from confidence in economic growth and stability. On the other hand, a "risk-off" environment paints a picture of investor caution and a preference for safety. During these periods, investors tend to gravitate towards lower-risk, more stable assets, even if the anticipated returns are comparatively lower. This shift is typically driven by concerns about economic uncertainty, geopolitical instability, or other factors that could negatively impact markets.

What are the key assets to track to understand risk sentiment dynamics?

Understanding the dynamics of risk sentiment is crucial for making informed investment decisions. Several key indicators can help investors gauge whether the market is in a "risk-on" or "risk-off" mode. These indicators span across different asset classes, providing a comprehensive view of market behavior.

Equities (Stocks): The performance of the stock market serves as a primary indicator of risk sentiment. Generally, during "risk-on" periods, stock prices tend to rise as investors become more willing to invest in companies and drive up valuations. Conversely, during "risk-off" periods, stock prices typically decline as investors become more risk-averse and sell off their holdings.

Commodities: With the notable exception of gold, most commodities tend to appreciate in value during "risk-on" periods. This is largely attributable to positive economic growth forecasts, which lead to increased demand for raw materials used in manufacturing and infrastructure projects. The expectation of a booming economy fuels the demand and consequently the prices of commodities like oil, copper, and agricultural products.

Currencies: The currencies of nations that heavily rely on commodity exports often strengthen during "risk-on" periods. This appreciation stems from the increased demand for their commodities, leading to a greater inflow of capital and boosting the value of their currency.

Cryptocurrencies: In general, the values of cryptocurrencies tend to increase during "risk-on" environments. Investors with a higher risk tolerance may allocate capital to this relatively new and volatile asset class when feeling optimistic about the broader market.

Bonds: Government bonds, particularly those issued by major economies with strong credit ratings, typically experience an increase in value during "risk-off" periods. Investors flock to these bonds as a safe haven, seeking the stability and security they offer during times of market turmoil. This increased demand drives up bond prices and lowers yields.

Gold: Gold is widely recognized as a safe-haven asset, and its value generally appreciates during "risk-off" periods. Investors turn to gold as a store of value and a hedge against inflation and economic uncertainty, driving up its price when risk aversion is high.

Safe-Haven Currencies: Certain currencies, such as the Japanese Yen, the Swiss Franc, and the US Dollar, are considered safe havens and tend to strengthen during "risk-off" periods. These currencies benefit from their perceived stability and the underlying strength of their respective economies.

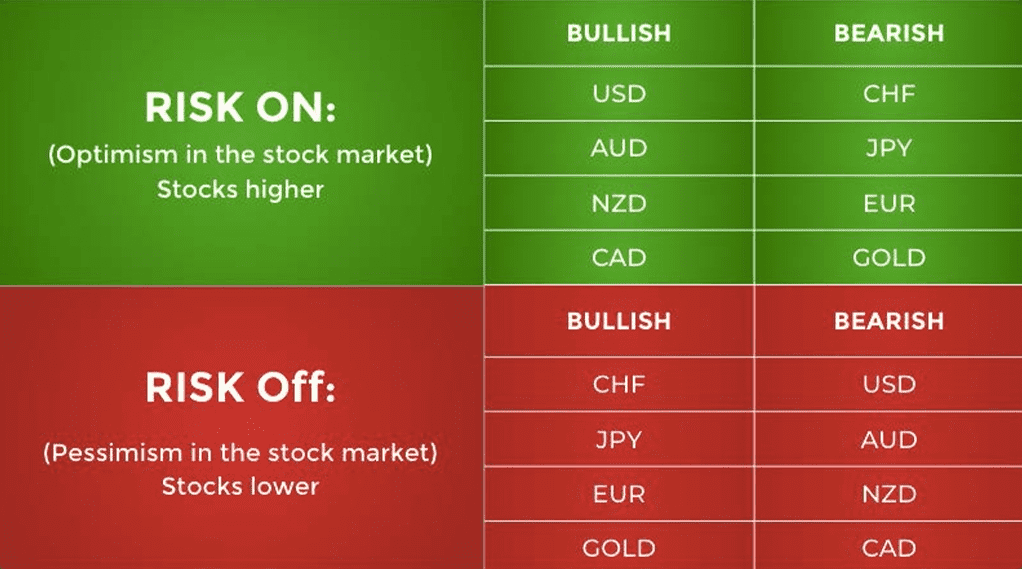

Which currencies strengthen when sentiment is "risk-on"?

Looking more closely at specific currencies, those that usually gain strength during "risk-on" periods include the Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD), and certain less prominent currencies such as the Russian Ruble (RUB) and the South African Rand (ZAR). The primary reason for this appreciation lies in the significant role of commodity exports in these economies. As global economic activity and optimism rise, the demand for commodities increases, leading to higher prices and boosting the value of these commodity-linked currencies. The increased export revenue supports their economies and makes their currencies more attractive to investors.

Which currencies strengthen when sentiment is "risk-off"?

On the other hand, currencies that typically strengthen during "risk-off" periods are the US Dollar (USD), the Japanese Yen (JPY), and the Swiss Franc (CHF). The US Dollar benefits from its position as the world's reserve currency, a status that grants it exceptional demand during times of crisis. Moreover, the increased demand for US government debt, viewed as a safe and reliable investment due to the perceived strength and stability of the US economy, further supports the dollar. The Japanese Yen benefits from consistently strong demand for Japanese government bonds. These bonds are largely held by domestic investors who tend to maintain their holdings even during periods of market stress, providing stability to the Yen. Finally, the Swiss Franc's strength is often attributed to Switzerland's stringent banking regulations. These regulations offer investors increased capital protection, making the Swiss Franc a desirable safe haven during times of financial uncertainty and risk aversion.